This is the Sponsored paywall logged out

As customer expectations of their service experiences increase and become more complex, utilities are still struggling to get the fundamentals right. Jane Gray reports on insights and best practice shared at the Utility Week Customer Summit 2020.

The fundamentals of a solid customer experience are pretty straightforward. Let customers know what to expect, and then consistently deliver on that expectation. It’s not a complicated recipe, but cross-sector indices of customer satisfaction suggest it is one that the utilities sector as a whole is still struggling to get right.

What’s more, this failure to get a handle on the fundamentals of customer experience now runs a serious risk of undermining the shift to higher value, service-based business models that utilities need to execute if they are to survive a drive towards a zero marginal cost of energy and increasing water scarcity. This was the urgent message that ran across the two days of Utility Week’s 2020 Customer Summit, including dedicated days for the energy and water sectors.

What’s more, this failure to get a handle on the fundamentals of customer experience now runs a serious risk of undermining the shift to higher value, service-based business models that utilities need to execute if they are to survive a drive towards a zero marginal cost of energy and increasing water scarcity. This was the urgent message that ran across the two days of Utility Week’s 2020 Customer Summit, including dedicated days for the energy and water sectors.

Several Summit speakers were keen to subvert the “conventional wisdom” about poor-performing, profiteering utility companies who care less about customer experience than reaping returns. They rightly pointed to the travails of an energy retail sector where profitability seems a pipedream for some, at least while the price cap lasts. And they also shared evidence about the contributions to decarbonisation and community wellbeing that these private utilities consistently deliver.

However, notwithstanding these facts, it can’t be denied that utilities have occupied a bottom ranking in cross-sector indices for customer satisfaction for a long time and that some straightforward service failings are compounding the sector’s persistent issue with public trust.

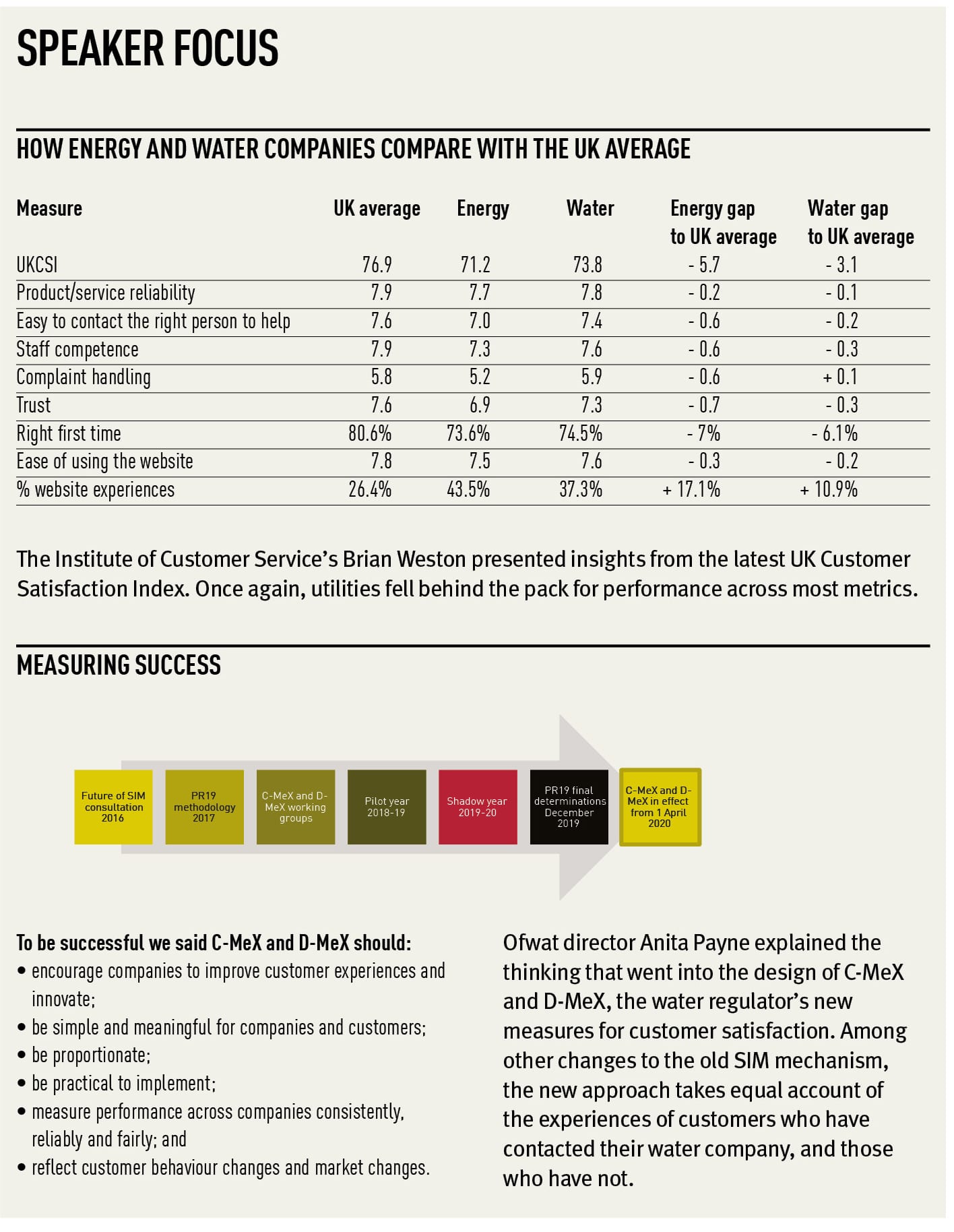

This is clear when you take a look at the Institute of Customer Service’s (ICS’s) UK Customer Satisfaction Index (UKCSI), which has run since 2008. The utilities sector has never made it off the bottom two rungs of the ladder, which measures performance across 13 segments of the economy.

At the summit, ICS director of research and insight Brian Weston shared insights from the latest iteration of the Index, released in January this year. He revealed that while water utilities exceed the cross-sector average for complaints handling, energy and water companies generally fall behind in every dimension of satisfaction covered by the survey.

Furthermore, while utilities had been making some steady satisfaction gains between 2015 and 2017, they have since lost ground and currently sit almost 3 index points below their best performance and 4.6 index points behind the cross-sector average.

Lower than average levels of consumer trust in utilities are certainly part of this unedifying picture. But far more prominent in the UKCSI is customer dissatisfaction with utilities’ ability to achieve “right first time” issue resolution for customers.

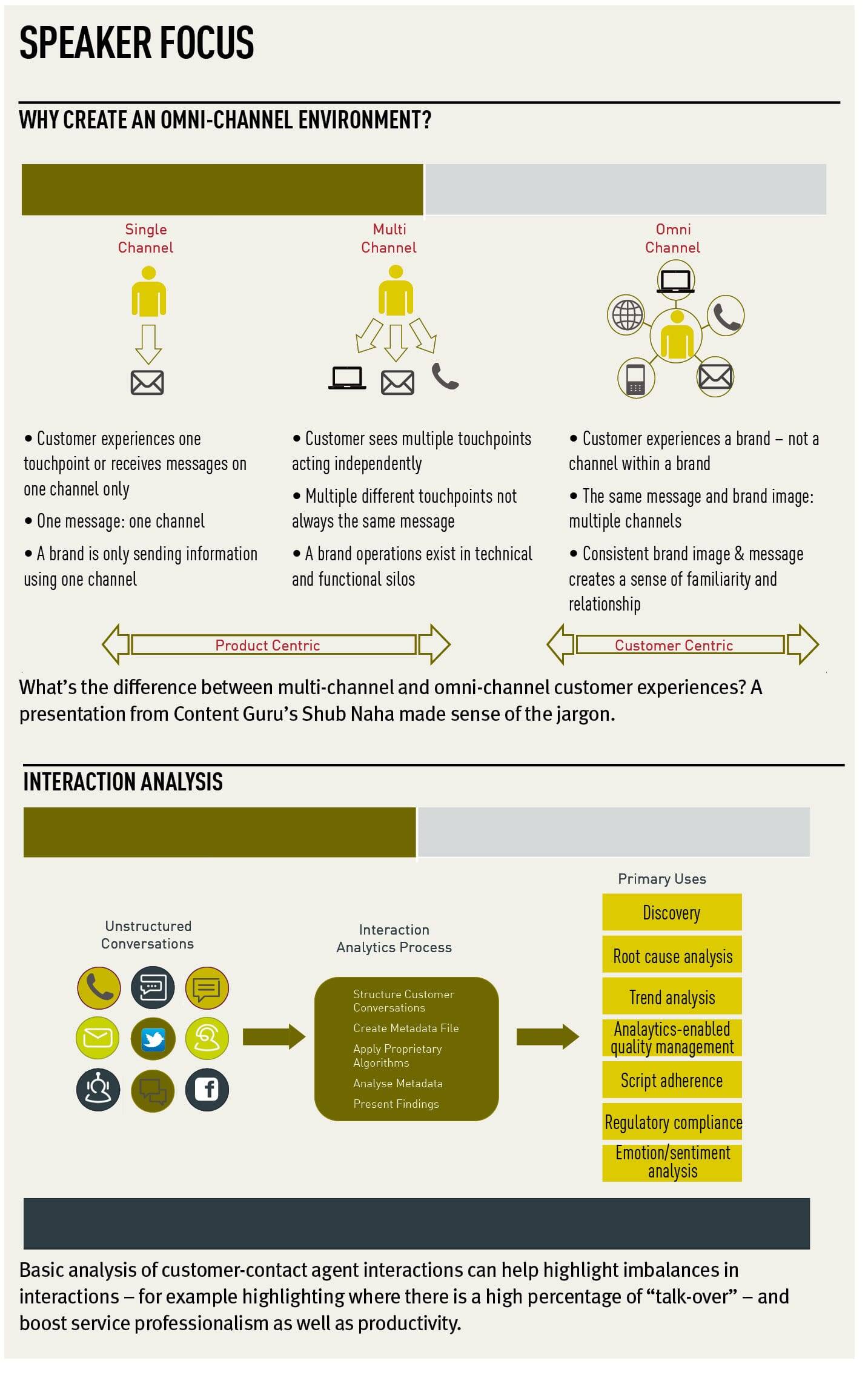

This is a worry – in that it’s a commonly accepted service fundamental that essential service providers really ought to be great at. But it’s also reassuring, since recent leaps in contact centre technology and so-called omni-channel service mean utilities have some great new tools available to them that could significantly alter customer experiences.

This is a worry – in that it’s a commonly accepted service fundamental that essential service providers really ought to be great at. But it’s also reassuring, since recent leaps in contact centre technology and so-called omni-channel service mean utilities have some great new tools available to them that could significantly alter customer experiences.

Presentations from technology partners at Utility Week’s Customer Summit emphasised this opportunity with insights into best practice for “inclusive service design” on digital platforms, the importance of enabling great “self-serve” experiences wherever possible and the opportunities for productivity and service professionalism opened up by advances in Natural Language Processing.

The important thing about applying these technologies, it was stressed, is not to think that they defer responsibility for providing “human” service – especially for customers experiencing very niche problems or with very particular needs.

The point about technology – coupled with effective use of customer data – is that it should be used to enable creative, personalised service en masse or to free up time and resource to provide one-to-one bespoke service for moments that matter.

A great demonstration of the first point was provided by Octopus Energy’s Rebecca Dibb-Simkin, who explained how the challenger brand had stumbled on research which showed the majority of people are most heavily influenced by music at the age of 14. Using this insight, the company took the initiative to build an algorithm which matches customer date of birth information with the number one single on release at the time they turned 14. If it was necessary to place that customer on hold during a call, this is the music that will play to fill the hold time.

There’s no doubt this is something of a gimmick, and of course not every customer was delighted with their allocated hit. But the approach to using technology as a bridge to help connect with customers on a personal level is a striking one that seems to set Octopus apart from many more traditional utilities.

It was Octopus, too, which showed how to effectively match technology with an organisational structure that maximises human service potential. The company has a flat structure that focuses on empowering “energy specialists” or frontline service staff to deliver end-to-end issue resolution for customers.

This means keeping all customer records in a single repository and giving staff the authority to fix issues without the need to make endless data requests of colleagues in different organisational silos or pass customers from pillar to post. The result is high first-time resolution of issues and a reputation for attentive, one-to-one service. What’s more, as the company grows – it took on Co-op Energy’s customers and employee base in 2019 and has recently acquired Engie’s energy retail business – the approach seems to be scaling up well.

Whether this approach would deliver the same results for all utilities is a moot point. But what is certain is that companies across the energy and water sectors need to think hard about whether their legacy approaches to managing customer contacts and deploying service technology will give them the relationships, reputation and engagement they need for the future.

As urgency builds around the decarbonisation agenda and awareness grows – albeit at a frustratingly slow pace – around the seriousness of the UK’s water scarcity threat, utilities need to be confident that they can have efficient and productive interactions with customers, both on a proactive and reactive basis.

Without this, they will never gain the currency they need with consumers to begin influencing behaviours and shifting demand. And without that, decarbonisation and the creation of sustainable, service-led business models will stall.

Key takeaways

1. Trust is a barrier to future business models. Low levels of trust are a major blocker to better customer engagement and successful service/business model innovation – this is worrying in the face of the climate crisis, which will require engagement and behaviour change from consumers.

2. Consistency in service experiences is key. Almost two-thirds of customers will leave a provider if they experience just one or two instances of poor/below expectations service.

3. Price is still the overwhelming factor driving consumers switching. The fear of a supplier going bust has increased in recent years, but still only ranks as fifth most cited reason.

4. Customer-centricity is easier said than done. Utilities both consciously and unconsciously create products and experiences that are based on industry workflows or organisational technology infrastructure, not what is best for the customer.

5. Customer satisfaction metrics need to keep pace with industry and consumer trends. Some network operators complained that Ofgem’s Broad Measure of Customer Service is no longer fit for purpose.

6. Vulnerability is not a minority issue. Therefore inclusive service design should be the industry baseline.

7. Customer focus is a cultural issue. Designing customer-focused services requires culture change and empathy from the boardroom down.

8. Smart meter installation is still patchy and delivering inconsistent experiences. Ofgem suggested it would support a movement for collaboration between energy retailers to increase smart meter installations on a regional basis.

9. Smart DCC may face new service measures. Ofgem is considering the design of a new measure for customer satisfaction with the DCC. News on this is expected in February.

10. Climate stress is driving water engagement push. Water companies are trying to raise awareness about water scarcity and consumption. This is driving a focus on securing more accurate consumption data to maximise the impact of these initiatives.

Digital hits and misses

A pre-conference workshop on servicing vulnerable customers, hosted in association with Mando, asked participants to identify key “hits and misses” they had experienced when trying to take digital service to vulnerable customer groups. Here are some highlights:

Hits

• There is widespread confidence that options for online account management, including via smartphone apps, have increased accessibility and the ease with which certain vulnerable customer types can manage their energy. These now frequently include options for multiple first language options.

• Most companies are using social media to raise awareness of the support they can provide to vulnerable customers.

• Effective accessible service design was felt to have improved across the sector, with better testing processes in place to validate inclusiveness of new services.

• Many suppliers have been thoughtful about how to provide power of attorney for customers with conditions such as dementia and ensure easy digital account management in those cases.

• Confidence in “omni-channel agility” is growing, increasing accessibility and the ability to track customer journeys – an important factor in serving vulnerable customers.

• While the smart meter rollout has its challenges, most agreed that this force for digitalised energy services has provided a platform for engaging better with customers as a whole and has helped to identify customers in vulnerable circumstances.

Misses

• There has been slow progress on data sharing to enable better support for vulnerable customers.

• Many suppliers still do not have a single coherent view of customer data and information about their vulnerability status.

• Suppliers have generally been slow to capitalise on smart home technologies such as Amazon Echo (Alexa) to increase the accessibility of their services.

• Some suppliers remain worried about their ability to serve the “digitally disengaged” – especially older customers.

• Utilities are not consistently supporting “preferred channel” options for customers.

This workshop also asked participants to identify the top barriers to customer engagement and suggest pledges they could make to improve customer journeys, especially for those in vulnerable circumstances.

Among the top pledges made was a commitment to include a requirement in Energy UK’s vulnerability charter for every supplier to nominate a senior leader to take responsibility for improving services for vulnerable customers.

Look out for further insights into this workshop at utilityweek.co.uk as Mando reviews prominent discussion points and lessons in serving vulnerable customers.

It’s time water retail put customers first

James Wallin reviews discussion and lessons for the water retail market that emerged from dedicated sessions at the Utility Week Customer Summit.

With the non-domestic water retail market fast approaching its third anniversary, there is a shared sense of urgency about getting the basics of customer service right.

This was the clear message from Utility Week’s Water Customer Conference, which brought together retailers, wholesalers, the sector’s watchdog and other stakeholders to discuss lessons learnt and challenges ahead.

There was acceptance that in the run-up to market opening the customer journey had often been sidelined while the focus was – understandably – on compliance and keeping to the timetable.

Retailers such as Nish Dattani of First Business Water accepted that the industry has so far failed to live up to the expectations of customers. Dattani went further to say that in some cases retailers were guilty of over-promising and under-delivering.

Steve Arthur, of market operator MOSL, stressed that customers need to be able to make informed choices and this was a key selling point of introducing competition. However, until legacy issues with data and meter reads are resolved, this integral offer is going to continue to fall short.

But there were positive signs from the Consumer Council for Water, whose deputy chief executive, Phil Marshall, revealed that the group’s data for Q3 2019 shows the third consecutive quarterly fall in complaints.

There was also discussion around the various definitions of customer in the market. For wholesalers there is still a direct relationship with the end user as well as with the retailers they supply. This relationship and the balance of responsibilities within it has been at the heart of many of the friction points in the market, but as Simon Bennett, chair of the Retailer/Wholesaler Group, pointed out, these barriers are being broken down as all parties align around the common cause of improving the experience for non-household customers.

As many speakers – including Wave Utilities’ Oliver Shelley – pointed out, if rapid improvements are not made to the level of service being provided to customers, it will start to hinder the switching process itself, as apathy sets in.

All participants agreed that at next year’s summit, the market cannot still be talking about “legacy issues”.

James Wallin, digital editor, Utility Week

Key takeaways

1. SMEs are being left behind. The benefits of market opening have so far chiefly been felt by bigger players.

2. Smart thinking is needed. According to First Business Water’s Nish Dattani, smart meters can be a powerful tool in tackling the sector’s multiple issues with providing accurate data to customers.

3. Consumption isn’t top of the list. The non-household sector accounts for a quarter of the UK’s water consumption and the industry is clear in its responsibility to drive water efficiency. However, CCWater’s Phil Marshall said there is little data showing it as a real motivation for business customers, aside from saving money.

“Customers want freedom”

Comment Shub Naha, Business development director for utilities, Content Guru

Shub Naha, business development director for utilities at Content Guru, offers his takeaways from both the Utility Week Customer Summit and a private speakers’ dinner that bridged the energy and water days of the event.

Shub Naha, business development director for utilities at Content Guru, offers his takeaways from both the Utility Week Customer Summit and a private speakers’ dinner that bridged the energy and water days of the event.

It’s very clear that, thanks to the emergence of incredibly convenient services from companies such as Netflix, Airbnb and Deliveroo, today’s customers expect more from all companies — including those supplying utilities. They want to personalise their user experience, and for utility providers to intuitively understand their needs.

While the combination of new connected digital technologies coupled with the requirement for the industry to leverage more from existing assets is driving new types of collaborations, service experience remains the key differentiator in the sector. As such, utilities organisations are under constant scrutiny and regulatory pressure to provide excellent customer experiences, and the increasing expectation to protect vulnerable customers only adds to this.

Customers expect the freedom to engage with providers however and whenever they wish, and to move seamlessly between different channels, such as social media, webchat and phone, particularly in moments that matter such as during a loss of supply. It’s important that utility organisations have the right solutions in place to gain a clear picture of the customer journey, irrespective of channels, ensuring that it can provide best-in-class customer engagement and experience.”

Please login or Register to leave a comment.