You’ve reached your limit!

To continue enjoying Utility Week Innovate, brought to you in association with Utility Week Live or gain unlimited Utility Week site access choose the option that applies to you below:

Register to access Utility Week Innovate

- Get the latest insight on frontline business challenges

- Receive specialist sector newsletters to keep you informed

- Access our Utility Week Innovate content for free

- Join us in bringing collaborative innovation to life at Utility Week Live

The gas sector is two-thirds of the way through a 30 year programme to replace 'at risk' iron gas mains, within 30m of buildings. But with each pipe presenting a unique set of risk characteristics and renewal costs and benefits, how can gas distributors plan their forward work programmes? Cadent has turned to software provider Probit, as Tim Watson explains.

Replacement work on gas pipelines derives from Ofgem and the Health and Safety Executive’s Iron Mains Replacement Programme, which requires UK distributors to commit to a schedule leading to replace of their iron mains by 2032. While the programme itself began in 2002, in recent years its implementation has been driven by technologies that can help optimise and work schedules.

At Cadent, the UK’s largest gas distributor managing a network of more than 131,000km, that means renewal of approximately 1,700km of iron mains annually. This large scale programme is being coordinated by advanced data analytics to drive efficiencies, specifically asset investment planning software from Probit.

Historically, this kind of analysis would have been labour intensive, using an array of spreadsheets and databases. The scale of Cadent’s asset base would also create a challenge for more traditional Asset Information Planning and project portfolio tools, which might require the aggregation of assets into cohorts or split the problem into many smaller ones – resulting in unnecessary and inefficient data processing and suboptimal decisions.

On the other hand, robust optimisation and scheduling of the pipe renewals has the potential to drive major cost efficiencies while still maintaining key performance targets, such as interruptions to supply, health and safety, and environmental targets.

Aiming for improvement

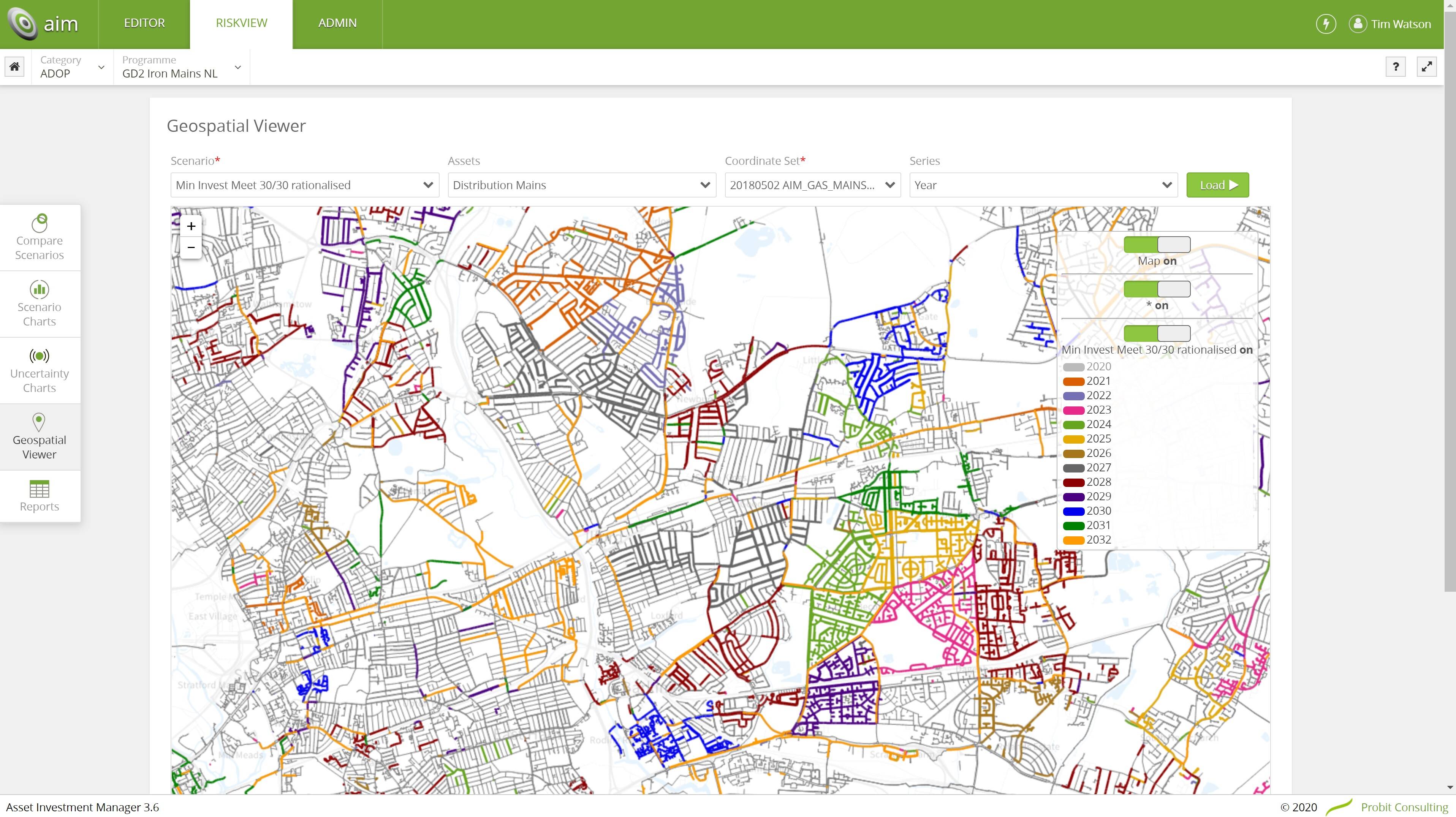

Cadent selected Probit’s AIM – Asset Investment Manager – software in a competitive process. AIM can interpret dynamic relationships and optimise investment for specific operational requirements and performance targets over a given time horizon.

It is able to measure the current health of assets and how they would perform over time, identify which distribution mains to prioritise for renewal, assess the relative benefit of each pipe renewal, understand the likely cost and coordinate the work so that it can be done in the most economical and timely way.

Dr Tim Watson, Probit’s director of analytics, explains: “Gas companies and other asset intensive utilities like Cadent have a large quantity of good quality data about the age, size, materials, pressure and locations of pipes in the network. The AIM platform is designed to take full advantage of this data and connect directly with many data sources at asset level.

“These include business operations and asset management software, database management systems, geographical information systems (GIS) and spreadsheets. Where data is limited, industry-accepted models or expert opinion are used and stored in a templated model library in AIM.”

Reducing the risk

Cadent’s Distribution Mains Renewal plan is focused on low, medium and intermediate pressure pipes of two to 48 inches (50-1220mm) in local transmission systems.

Within this programme, the AIM platform is being used to assess the health of each pipe and predict how it will perform over time, including how many failures it will have and how that will change with age, depending on materials and other factors.

The software can also assess the consequences and cost of failure in terms of repairs, customer service and community impact, the risk to the environment from any release of carbon dioxide into the atmosphere, the health and safety risk from gas potentially trapped in buildings – gas ignition could cause explosion with risk of fatality and injury, and the assess risk of interruption of customer supply and potential penalties

The key strength of the model is that it can assess one pipe against another and indicate which should be renewed first. For example, the location of a given pipe might make it more expensive to renew, but if it is failing more often, and its failure has a greater impact on customers, the model can pick this up and show the greatest total benefit.

In December 2019, Cadent submitted its distribution mains renewal plan for RIIO-GD2, the gas distribution price control review that runs from April 2021 to March 2026.

The programme of works comprises three elements, the most significant of which is the HSE-mandated renewal of all iron mains of 8-inch (203mm) diameter and below, situated within 30m of a building. These pipes comprise 93% of all renewal work. The Probit AIM model is programmed to ensure completion of the iron mains work by 2032, in accordance with the HSE aspirations.

The second major element of the mains renewal plan is other mains that are above the safety threshold but nevertheless require renewal, a cohort that mainly comprises ageing steel mains. The third element are known as “cost benefit assessment mains” (CBAMs), which are not necessarily a safety risk but are failing and are cheaper to renew than maintain.

The model is able to coordinate all three programmes together, delivering the whole renewal programme at optimal efficiency.

The AIM uses a powerful simulation and optimisation engine, capable of optimising for budget, resource, risk, serviceability, asset performance, whole-life benefit and whole-life cost.

It can produce “risk maps”, linking cause and effect, and calculate intervention benefits, such as the new failure rate following proactive replacement.

A scenario builder allows users to ask questions in an intuitive manner to assess the trade-off between risk, service and cost. Typical questions might be, if I do nothing, and just react, what will happen? What is the best level of service and least risk I can achieve with a limited budget? If I want to maintain my network in the same condition what will it cost? If I replace assets based on age what will it cost?

Sam McGauley, RIIO-GD2 mains renewal investment lead at Cadent said: “The GD2 Distribution Mains Renewal programme is a massive undertaking and the models generated by the AIM software are already providing us with a level of detail on pipe condition and costs we haven’t had previously.

“Building on the work we did with during the RIIO-GD1 price control, we have refined the digital tools over the last two years to help with Cadent’s RIIO-GD2 submission.”

Please login or Register to leave a comment.