You’ve reached your limit!

To continue enjoying Utility Week Innovate, brought to you in association with Utility Week Live or gain unlimited Utility Week site access choose the option that applies to you below:

Register to access Utility Week Innovate

- Get the latest insight on frontline business challenges

- Receive specialist sector newsletters to keep you informed

- Access our Utility Week Innovate content for free

- Join us in bringing collaborative innovation to life at Utility Week Live

Radical thinking amongst utility firms and government is critical for managing through this age of uncertainty, say Ted Hopcroft and Liz Parminter energy and utilities experts from PA Consulting.

Our energy industry is facing its most uncertain time  since its inception. It was already grappling with the challenges of transformation in generation, turmoil in retail and uncertainty in networks. Now, in addition, we have to deal with the hugely significant impacts of Covid-19 and the medium- and long-term drivers of net zero.

since its inception. It was already grappling with the challenges of transformation in generation, turmoil in retail and uncertainty in networks. Now, in addition, we have to deal with the hugely significant impacts of Covid-19 and the medium- and long-term drivers of net zero.

The composition, structure and geographic focus of our economy in a post-Covid world is extremely uncertain. Economists’ assessments of the impact of Covid vary between a V shaped recovery and the deepest depression for 300 years. It could bring a radical re-shaping of industry, commerce and working lives. Or, the new normal may look much like the old normal.

Further uncertainty prevails around the net zero ambition. Positively, 206 UK companies have written to the Prime Minister stating that economic recovery should prioritise climate and the chancellor is reportedly planning a green revolution. However, while there is currently a green groundswell, a fiercely competitive post-Covid global economy could test government, industry and consumer commitment to net zero. The aim could remain in law, but with actions continuously “pushed to the right” with assumptions that huge progress will be made in later years. Consumer reaction will be very important. The Covid experience may encourage them to embrace net zero, but it is equally plausible that unemployment and reduced wages will drive them to look for lowest cost products and services and rebel against any impact on cost or service arising from net zero.

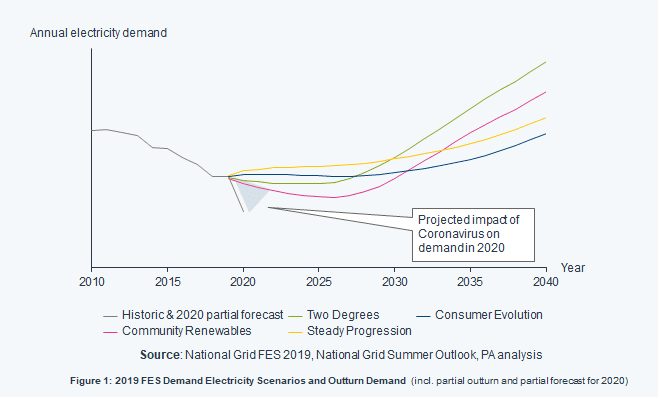

Traditional scenario planning is flawed in the face of this uncertainty. It tends to create clusters around projected norms, rather than envisage exceptional change. This is why the Future Energy Scenarios did not foresee the Covid induced fall in demand – that was not their purpose.

There is a need to think differently at times of crisis. Different skill sets and approaches are needed to stretch leaders’ thought processes so that they can adapt and orient to new and often more challenging situations than previously thought possible.

There is a need to think differently at times of crisis. Different skill sets and approaches are needed to stretch leaders’ thought processes so that they can adapt and orient to new and often more challenging situations than previously thought possible.

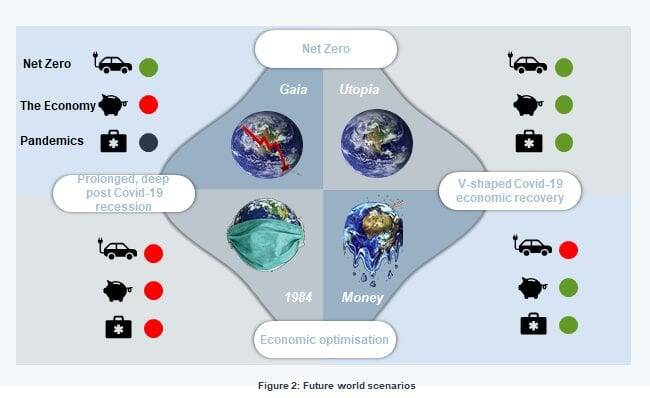

A key facet of this is to look not at scenarios, but at extreme but plausible versions of the world, their characteristics are determined by the key external drivers of uncertainty – such as speed of economic recovery and net zero. Each world is described, and the lead indicators developed. The lead indicators are monitored and used to show in which direction uncertain events are moving. This allows government, regulators and companies to track the lead indicators and re-orient strategy accordingly, or to directly change levers under their control. It is this capacity to ‘Observe, Orient, Decide and Act’ – the OODA loop -, that sets successful organisations apart.

We believe the scale of uncertainty is so great, that this approach could have significant merit for our industry. An agreed set of future worlds and indicators could provide a common framework for government, regulator and companies. This could, for example, provide the basis for more effective management of net zero through RIIO-ED2, the introduction of green energy schemes, or approaches to bad debt. To start the debate, we suggest four possible worlds:

We believe the scale of uncertainty is so great, that this approach could have significant merit for our industry. An agreed set of future worlds and indicators could provide a common framework for government, regulator and companies. This could, for example, provide the basis for more effective management of net zero through RIIO-ED2, the introduction of green energy schemes, or approaches to bad debt. To start the debate, we suggest four possible worlds:

Utopia

This is the world we most want to be in. Economic success and net zero go hand-in-hand, with a highly eco-efficient property and industrial base, supported by green distributed energy. This world would require very strong government policy intervention and funding for green programmes, with a supportive regulatory regime allowing spend ahead of need and probably some socialisation of investment cost. This would require a strong economic recovery; conversely the green investment itself may help drive recovery. Consumer acceptance and endorsement will be vital. The energy sector has already seen how difficult it is to get people to have a smart meter and net zero will demand a totally different order of customer engagement.

Gaia

The earth asserts itself, as James Lovelock’s hypothesis predicts. We meet net zero, but either with a severe economic downturn, or through the population reshaping its view of what is important. This world would require many of the same drivers as Utopia. They key difference is the economic underpinning of the move to net zero. Lead indicators for this world may be, for example, increased evidence of acceleration of global warming, leading to governments prioritising carbon reduction programmes as the expense of economic growth.

1984

This is the world we definitely don’t want to be in. Net zero is abandoned in pursuit of low-cost carbon energy, but economic stagnation persists. It is hard to countenance this world having just run for two months without coal, but the potential economic damage of Covid should not be underestimated. Lead indicators could be an increase in international trade fractures and poor post-Brexit trading arrangements and/or a second wave of Covid-19. All of these could damage the economy curtailing the drive for net zero, especially if oil and gas prices remain very low.

Money

Economic forces trump net zero. Commitments are abandoned as the pursuit of economic recovery necessitates the use of the cheapest energy resource – carbon in a post-Covid world. Lead indicators for this world could be increased consumer resistance to price and service impacts of net zero. For example, a fall in market share of green energy suppliers, or negligible uptake of electric vehicles due to their increased cost. A further indicator would be high levels of government debt, which could curtail any support for net zero initiatives.

All this underlines that we are not remotely in a business as usual environment. The energy sector will have to manage both the immediate challenges, adapt to the medium-term developments and prepare itself to exploit the new normal in the long term. That will require radical thinking and focused efforts to understand potential future worlds and how to influence and respond to them to establish an energy sector for the next thirty years.

Please login or Register to leave a comment.