This is the Sponsored paywall logged out

As the UK prepares for negative interest rates, Colm Gibson, head of economic regulation practice at Berkeley Research Group, asks might utility regulators be tempted to follow?

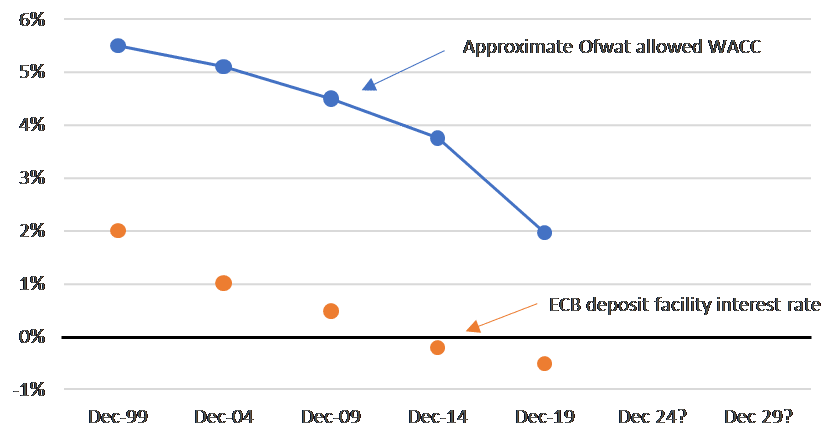

Traditionally the allowed weighted average cost of capital (WACC) in price controls has been in the middle single digits range. Recently, however, the WACC numbers adopted in regulatory determinations have been starting with a 1 in real terms (net of Retail Price Index (RPI) inflation). This begs the question; how low can it go? Indeed, might a combination of negative interest rates and low equity returns manage to push the regulatory allowed cost of capital below zero?

The allowed regulatory rate of return for utility companies has been heading slowly but inexorably downwards in the last decade or so. Although we are still technically awaiting Ofgem’s final position for RIIO-2 and the Competition and Markets Authority’s (CMA) redetermination of PR19, the trend is undeniable, for example, in the return allowed by Ofwat in successive price controls.

Negative interest rates are not new. Japan, Sweden, Switzerland, Denmark have all joined the “negative rates club” as the Financial Times calls it, and the UK may be set to follow if recent press reports are to be believed. Even some European Central Bank (ECB) rates have trended down below zero.

Admittedly the graph above shows ECB deposit rates rather than lending rates (which are still above zero – just), but the trend is clear. Indeed, it is only a few weeks since the FT was reported that the Bank of England “…has pivoted, and is now contemplating negative rates and planning how they might be implemented”, and that the UK Government‘s Debt Management Office (DMO) has sold around £3.8 billion worth of three-year government bonds with a negative yield of minus 0.003 per cent.

One of the dangers of negative interest rates for investors in regulated utilities is that it means that equities may not need to offer much return in absolute terms in order to reward equity investors for the extra risk they are taking relative to debt investors. Negative interest rates could, therefore, drive down the returns that regulators believe equity holders will be prepared to accept. I’m not suggesting that it likely that a regulator will manage to set a price control where the headline WACC is negative, but it is no longer inconceivable.

Arguably, Ofgem’s draft determination in early July 2020 makes a negative regulatory WACC easier by virtue of its application of an expected outperformance to calculate the headline allowed WACC value. This reduces the allowed return to equity by around 0.22 per cent to 0.25 per cent, adversely impacting the headline WACC by around 0.1 per cent.

Ofgem has received plenty of criticism (from the National Audit Office and others) for having been too generous in previous price controls. I would, therefore, have expected Ofgem to present its case so as to show that the allowance for expected outperformance was tough. This is not the case. Ofgem’s consultation is clearly written is such a way as to make the reader believe that the adjustment for expected outperformance is almost too modest – inviting respondents to the draft determination consultation to campaign for a greater expected outperformance wedge to be applied in Ofgem’s final determination.

In my view, Ofgem’s explicit allowance for expected outperformance should ring alarm bells for the four water companies (Anglian Water, Bristol Water, Northumbrian Water, and Yorkshire Water) who rejected Ofwat’s PR19 determination and took their case to the CMA. It was always going to be hard to argue for a materially higher return than Ofwat had allowed, given the potentially negative risk free rates implied by UK RPI-linked gilt yields, but Ofgem’s move, has made the hill they need to climb even steeper. For example, Ofgem’s document notes that “[e]quity analyst reports indicate potential PR19 outperformance of up to 3 per cent” for Severn Trent’s, United Utilities’ and Pennon’s shares, and describes Ofwat’s allowed return on equity as one of the main reasons why those shares traded at such large premia to their regulatory asset bases so soon after Ofwat’s final determination was made known.

If interest rates continue to get more negative, and if equity returns fall, and if adjustments such as expected outperformance become common place, a regulator in a future price control (eg PR24 or RIIO-3) might just be tempted to test a very low return in nominal terms, that corresponded into a negative return in real terms once inflation is deducted. This assumes, of, course, that inflation is positive. However, current inflation is low by historic standards, and there have been periods of negative inflation (deflation) in the UK in the past – often after a major crisis. There was significant deflation in the UK after the First World War, for example, and the UK economy has flirted with it more recently in the wake of the financial crisis. Since Covid-19 seems to be damaging both the supply side and the demand side of economies, it seems to me that there is every reason to believe that the global economic disruption in the wake of Covid-19 will be as traumatic for our economy as a war or financial crisis – so there is a real risk of deflation.

If there happened to be deflation, then investors in regulated companies could be faced with the peculiar circumstances where the WACC set by regulators in higher in real terms, than in nominal terms, increasing the chance that one or other is negative.

The allowed WACC is only part of the story, as the actual reward to shareholders is the WACC multiplied by the regulatory asset base (aka RAV, RAB, RCV, TRV etc). In economic terms, therefore, there is a balance to be struck between the allowed cost of capital and the allowed regulatory asset base, and more specifically between the inflation applied to the regulatory asset base, and more specifically, the inflation applied to the regulatory asset base. This means that investors can be happy with a lower WACC in the short term, if they secure a higher inflation index for their RAB, and vice versa.

The interaction between WACC and RCV indexation gives economic regulators a lever to pull – they can trade off the WACC against the RCV inflation (or run-off) rate. This means that they can disguise what is in practice a negative WACC by setting the WACC at a nominal (positive) and value playing with RCV indexation. Companies, therefore, need to be careful with the arguments they put to Ofgem and the CMA. It would be a rather pyrrhic victory if they were to succeed in securing a higher short term WACC from the CMA or Ofgem in return for slower RCV growth to the long-term detriment of their investors.

The views and opinions expressed in this article are those of the author and do not necessarily reflect the opinions, position, or policy of Berkeley Research Group, LLC or its other employees and affiliates.

Colm Gibson is a managing director in BRG’s London office, and head of BRG’s economic regulation practice for the UK, Europe, the Middle East and Africa

Please login or Register to leave a comment.