This is the Sponsored paywall logged out

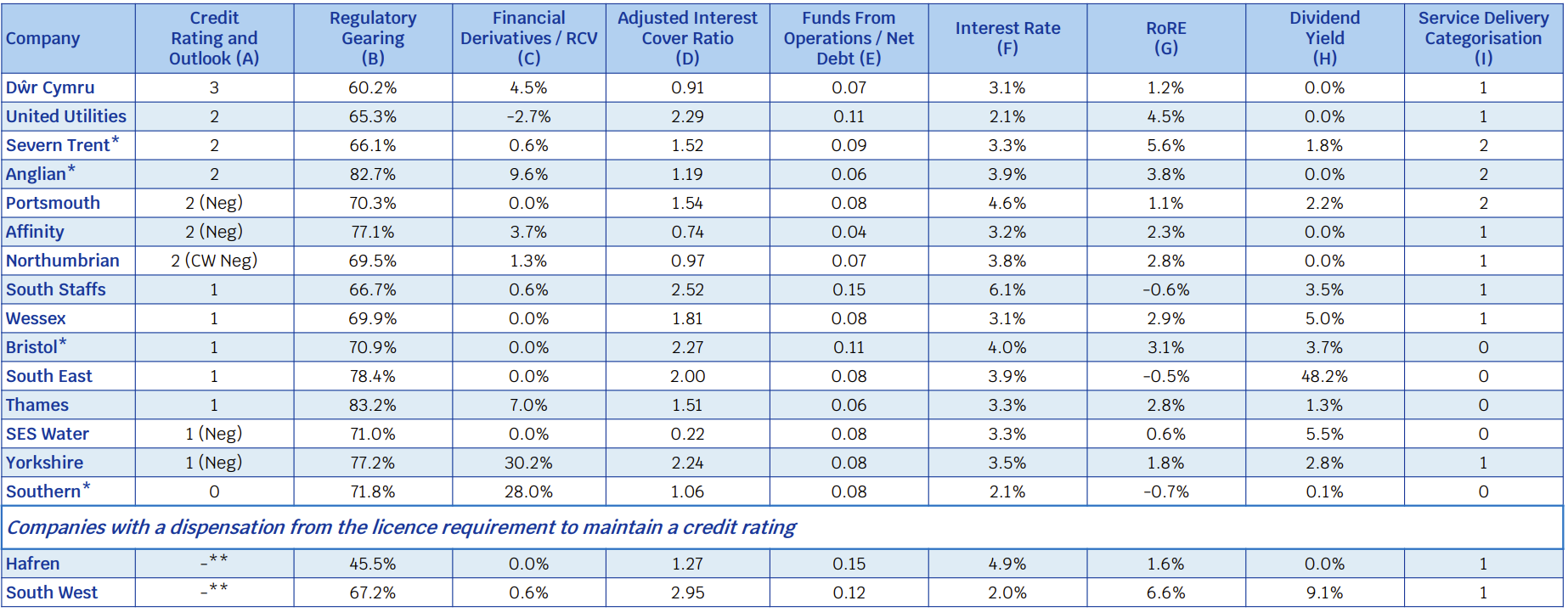

Concern over the financial resilience of SES, Southern and Yorkshire has been expressed by Ofwat in its review of sector-wide financial structures for the first year of AMP7.

The regulator said it considered the three companies to have weaker levels of financial resilience than required, while Welsh Water, Severn Trent and United Utilities were said to have stronger resilience for the 12 months to 31 March 2021.

Overall, the regulator said companies were attracting investment but it recognised correlations between poor operational performance and weak levels of financial resilience.

While most companies maintained adequate levels of resilience, Ofwat’s dashboard highlighted variation in the levels of financial resilience across the sector.

During the year, Southern maintained a credit rating that was the lowest of the investment grade but after being bought out by Macquarie in September it received an equity injection of £1 billion into the business.

SES and Yorkshire each held credit ratings with negative outlooks that were one place above the lowest rating. However, SES’ rating from Moody’s has subsequently been upgraded from Baa2 negative to positive. Yorkshire’s Baa2 (negative) rating from Moody’s has been withdrawn since the year end. It maintains a stable A- rating from S&P.

Ofwat said it was “extremely disappointing” that most companies had not done enough to explain their rationale behind dividend payments to customers after Ofwat set out its expectations in this area. Although payments were lower in 2020/21 than previous years, the regulator said few companies adequately explained payments clearly to billpayers to show how they reflected the levels of service delivered.

In 2019 company licences were modified to include objectives for board leadership, transparency and governance within companies’ annual reporting as part of a wider mission by Ofwat to rebuild trust and confidence in the sector.

The regulator assessed that companies were, overall, managing to set out required statements of long term viability with impacts of risks, but asked for greater detail in the testing outcomes and the scenarios used in reporting.

Since the end of the financial year, significant changes have occurred including Bristol being acquired by Pennon Group and Southern being bought by Macquarie. Elsewhere Anglian unveiled a new financing structure that resulted in a significant decrease in its gearing and an upgrade to its credit ratings. Similarly Severn Trent raised around £250 million for Green Recovery schemes in May.

A discussion paper on the issue of financial resilience is due to be published this month.

Please login or Register to leave a comment.