This is the Sponsored paywall logged out

The further removal of renewables subsidies and the wider UK political uncertainty dampened investment appetite in the power and utilities sector in 2019. Dan Gambles charts the deals.

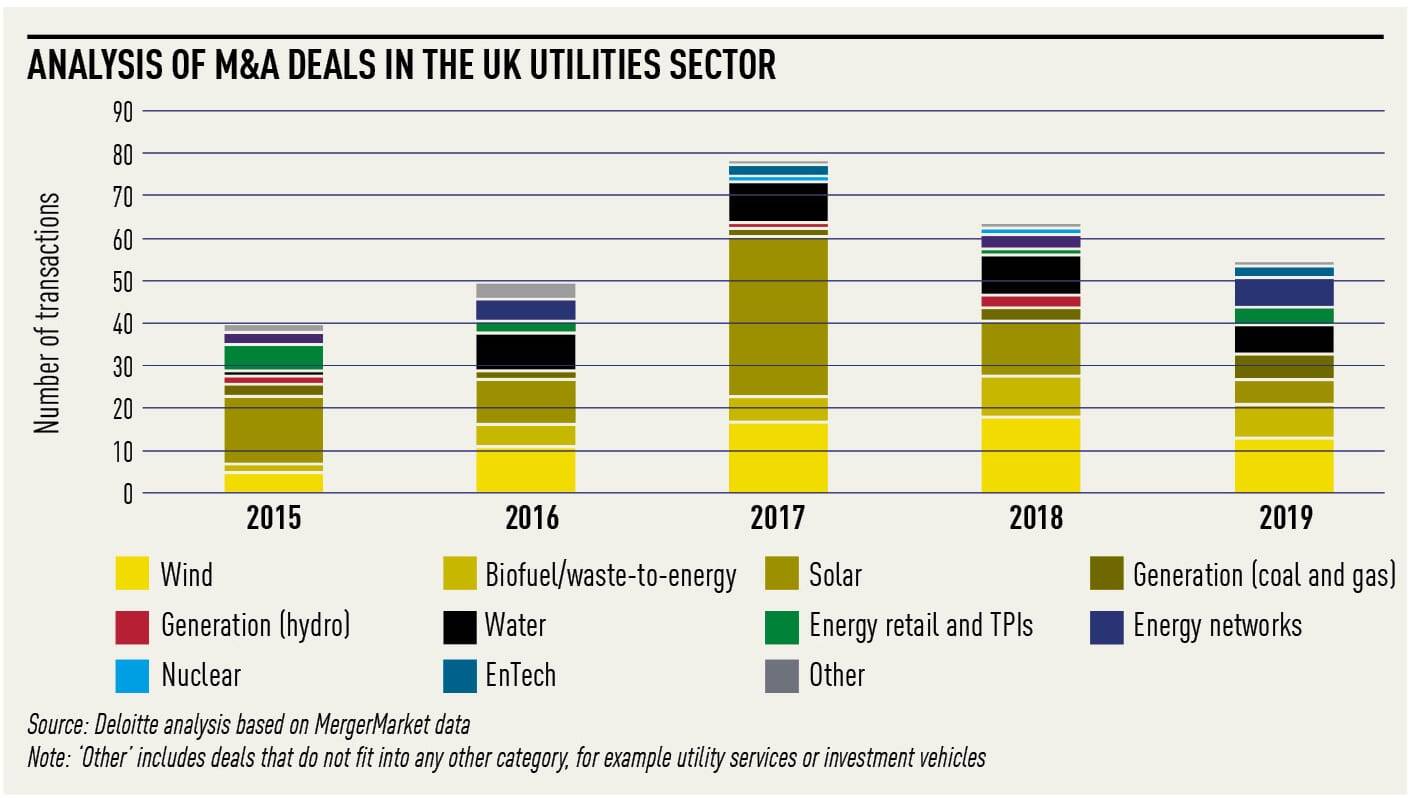

The UK power and utilities sector saw the number of mergers and acquisitions (M&A) transactions decline in 2019. Deal volumes were 12 per cent below 2018 levels and 30 per cent below 2017 levels due to a drop in renewable sector deal numbers.

The UK power and utilities sector saw the number of mergers and acquisitions (M&A) transactions decline in 2019. Deal volumes were 12 per cent below 2018 levels and 30 per cent below 2017 levels due to a drop in renewable sector deal numbers.

The further removal of renewables subsidies and the wider political uncertainty in the UK dampened investment appetite in the sector. Apart from a small number of £1 billion-plus transactions, the majority of deals were smaller than seen in recent years.

This analysis covers M&A transactions where the target is based in the UK, across the generation (coal and gas), renewables (wind, solar, hydro and biofuel/waste-to-energy), nuclear, water and waste, energy networks, energy retail and third-party intermediaries (TPIs), and energy technology (EnTech) sectors.

The number of UK power and utilities M&A deals reduced from 64 in 2018 to 55 in 2019. This reduction was mostly due to a drop in the number of deals in the wind and solar sectors. Seven water sector deals were completed during the year, compared with ten in 2018, and the number of biofuel/waste-to-energy transactions also reduced from ten to eight. The three sectors where deal numbers increased notably were energy retail/TPIs, energy networks and EnTech.

There were a number of significant deals during the year – the sale of National Grid’s remaining interest in Cadent Gas, the sale of Electricity North West and the sale of Iberdrola’s stake in the East Anglia ONE offshore wind farm.

Subdued M&A activity in solar and wind

The solar and the wind sectors saw the number of transactions fall during the year. The number of solar deals reduced from 13 in 2018 to six in 2019, while the number of wind transactions dropped from 18 in 2018 to 13 in 2019. This decline was largely due to the closure of the Renewables Obligation subsidy scheme to all new generating capacity at the end of March 2017. This caused a spike in deal numbers in 2017, coupled with the lack of participation by both solar and onshore wind in the contracts for difference (CfD) auctions. While these continued to hinder investment in developing and building new farms, interest by institutional investors in operating assets continued during the year.

In solar, nearly all deals were sales of operating assets, with NextEnergy Solar Fund, Greencoat Capital and Arjun Infrastructure Partners all adding solar assets to their portfolios.

In wind, one of the largest acquisitions of the year related to the purchase of Iberdrola’s 40 per cent stake in the East Anglia ONE offshore wind farm by the Green Investment Group. While Equitix, Greencoat UK Wind, and Pensions Infrastructure Platform also acquired wind farm assets, three transactions focused on investing in companies that develop, construct and operate assets or provide equipment parts and services to wind farm manufacturers and operators.

The water sector also saw lower M&A activity during the year. While those interested in the sector wait for PR19 to conclude, deals in 2019 were modest and focused on companies that provide water services, treatment products and systems.

Attracting foreign investment

Two major energy network assets attracted interest from foreign investors in 2019. One was the Electricity North West electricity distribution business, whose new owners include a Japan-based consortium of companies.

The second asset was Cadent Gas, in which National Gas sold the remaining stake to a Macquarie-led consortium of investors called Quadgas. After acquiring 61 per cent of the company three years ago, Quadgas is now the full owner of Cadent Gas, a network that distributes natural gas to 11 million UK homes and businesses.

Consolidating energy retailers

The UK energy retail sector is facing several pressures currently, including customer performance, increased price competition and the default tariff price cap. These pressures have led to an increase in M&A activity in the sector as investors, challengers and incumbents wrestle with the new environment.

There were a number of company insolvencies in the sector – which do not count as M&A deals under the Supplier of Last Resort arrangements – but challenger retailers who are breaking into the “big six” also started to emerge, as Octopus Energy’s acquisition of Co-operative Energy and Ovo Energy’s purchase of SSE Energy Services show.

Mitsubishi’s acquisition of a 20 per cent stake in Ovo Energy and Shell’s purchase of Hudson Energy Supply are signs of businesses aiming to participate in the UK’s low-carbon transformation. The EnTech deals, which are still modest in volume and numbers, include the acquisition of Charge Point Services, which provides charging equipment for EVs, and that of Harmony HB, which operates a battery storage facility.

Outlook for the sector

While the outlook for the sector as a whole is strong, the coming year could be another quiet one from an M&A perspective as the regulatory and political headwinds will continue to exist.

Deloitte does not anticipate significant investment into developing and building new solar and onshore wind farms, so expects the number of such deals to remain low in 2020. However, developers are now looking to create assets that can be profitable subsidy-free – for example, by combining solar power with battery storage solutions.

The water sector is also likely to see a subdued level of M&A activity in 2020 until the PR19 process is finalised.

2019 saw a number of transactions driven by the increasing interest in energy transition. With the UK’s commitment to shift the economy to being net zero by 2050, a world of opportunities will open up for businesses to participate. What companies need now is political and regulatory guidance on timelines and direction of travel to start unpacking the business case for investment.

Please login or Register to leave a comment.