You’ve reached your limit!

To continue enjoying Utility Week Innovate, brought to you in association with Utility Week Live or gain unlimited Utility Week site access choose the option that applies to you below:

Register to access Utility Week Innovate

- Get the latest insight on frontline business challenges

- Receive specialist sector newsletters to keep you informed

- Access our Utility Week Innovate content for free

- Join us in bringing collaborative innovation to life at Utility Week Live

In its final determinations for gas and transmission networks and methodology for the electricity distribution price control, Ofgem appears to have moved much closer to the government’s vision for net zero. Nicholas Cass-Tansey and Allan Boardman, energy and utilities experts at PA Consulting, give their views.

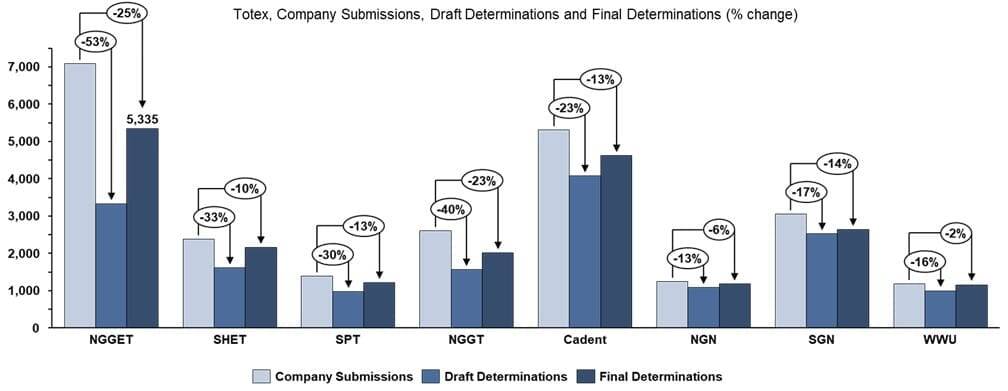

Last week Ofgem released the final determinations for transmission and gas distribution companies for the RIIO2 price controls beginning April 2021. In July’s draft determinations Ofgem adopted a tough stance reducing company returns, focussing on reducing bills and challenging companies on their business plan proposals which saw a 33 per cent reduction in baseline totex compared to their submissions (45 per cent for transmission networks’ business plans) and £140 million of penalties applied to companies under the new Business Plan Incentive.

Whilst Ofgem’s focus has been on reducing customer bills and achieving net zero at the lowest cost, UK government policy has shifted substantially, with the prime minister’s ten-point plan announced last month, and the Energy White Paper published this week. The white paper sets out over £12 billion in investment targeting a number of key areas including committing to Giga-scale nuclear, electric vehicle (EV) infrastructure, hydrogen and decarbonising traditional heating among others, all of which will see UK electricity consumption doubling by 2050.

It is clear the government has emphasised the importance of the energy sector in the green industrial revolution, to not only address climate change but to support the Covid-19 economic recovery. This has not only led to further pressure from network companies and the wider industry about Ofgem potentially hampering this ambition but also involved intervention from the BEIS Committee to Ofgem highlighting that they want to “prevent a repeat of the Competition and Market Authority appeal currently ongoing for the water industry”.

The key question everyone is asking, is has Ofgem done enough to stop companies from heading to the CMA following in the footsteps of Anglian, Northumbrian, Bristol and Yorkshire Water in PR19?

Ofgem loosens its grip

Initial indications suggest that Ofgem has loosened its grip and there has been some significant movement. Is this because they have understood the political imperatives? Or is it because the companies have been able to provide better evidence to justify expenditure? Whatever the situation there has been substantial movement and Ofgem seems to be closer in alignment to the government’s vision set out in the white paper, than it was in July at draft determinations. This appears to be reinforced by the recent RIIO-ED2 sector-specific methodology decision (SSMD) where Ofgem is “committed to delivering a greener, fairer future energy system working within the policy framework set by government” and has evolved the rhetoric around areas such as strategic investment for net zero.

Ofgem also looks to have changed its stance on totex, with an additional £4 billion in funding across the eight network companies, reducing the percentage disallowance between Ofgem and company proposals to 16 per cent (from 33 per cent disallowance at draft determinations).

The majority of this movement relates to non-load related expenditure (NLRE) where there has been an additional £1.4 billion of funds allowed. It might be argued that the £724 million in load-related expenditure could support net-zero ambition following the backlash from industry and government.

Ofgem has also addressed some elements of the financial package with the most significant change being to the cost of equity – increasing it from their initial position of 4.2 per cent to 4.55 per cent (including the 0.25 per cent outperformance wedge) with weighted average cost of capital (WACC) increasing from 2.63 per cent – 2.81 per cent.

The draft determinations gave companies a glimpse into how Ofgem was going to use the new business plan incentive, the new ‘carrot and stick’ incentive mechanism where companies can be rewarded or penalised based on the quality of their business plan submission and evidence. Early evidence from the draft determinations looked as though Ofgem was using more ‘stick’ with very little rewards and most companies receiving penalties.

However, the final determinations have illustrated the value of the incentive, rewarding companies on the quality of their submission and for revealing efficiencies.

Has Ofgem moved enough for companies not to head to the CMA?

The big question remains, has Ofgem moved enough to stop companies from putting forward its case to the CMA, given the recent success of the PR19 appeals? RIIO2 is due to start in April 2021 – making the timeline for any appeal to the CMA before then a very tight process with water outcomes unlikely to inform decision-making.

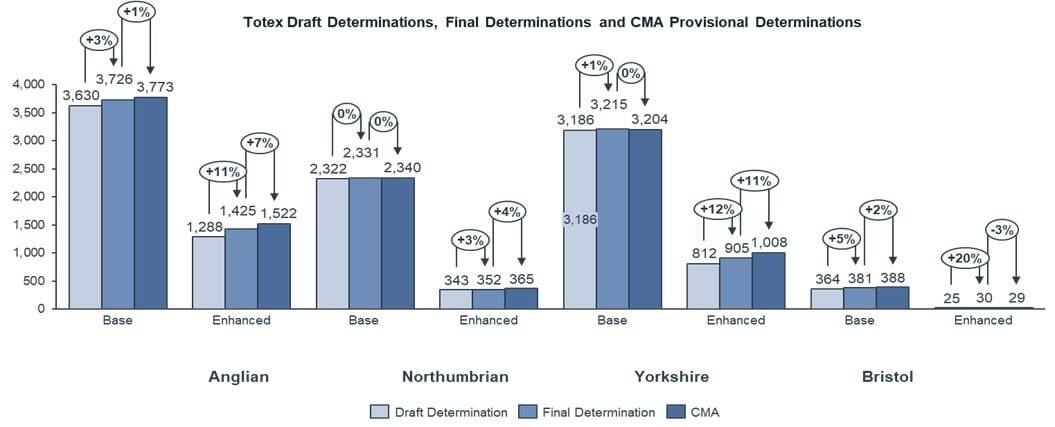

By far the biggest win for PR19 appellants was the increase in WACC to 3.5 per cent (0.5 per cent more compared to their peers). There was also some movement in totex, however not nearly as significant as the movement from draft to final determinations (see chart below). Whilst totex has increased from Ofwat’s draft determinations to final as more evidence came to light, companies were still asking for significant enhancements which the CMA did not award. This could be partly down to the high bar set by Ofwat for evidence and justification. Whilst the CMA addressed WACC and some areas of totex it steered largely clear of incentives package and accepting Ofwat benchmarking companies against the Upper Quartile on performance commitments. This may have influenced Ofgem’s direction in the RIIO-ED2 SSMD where the incentive package appears to be more challenging; in particular with the addition of a penalty and applying a common target for DNOs to the TTC/TTQ and reducing incentive rates for IIS.

With Ofgem moving on totex and the BPI and giving some movement in WACC from 2.63 per cent to 2.81 per cent, will this be enough to deter the industry? With movements in totex, WACC will remain the key factor which is still 0.2 per cent lower than Ofwat’s final determinations and 0.7 per cent below the CMA provisional determinations. This will be even more of a concern with the government discussing plans in the EWP for the competitive tending for the building, ownership and operation of the UK’s onshore electricity network – will the CoE be sufficient to address this increased risk networks will now have to accept?

A common approach for regulators – takeaways for electricity distribution

What is becoming evident is that regulators are adopting similar strategies to the price control process. Where, like Ofwat, Ofgem applied the ‘stick’ to companies in draft determinations with significant totex cuts and BPI penalties whilst giving way in the final determinations and rewarding companies for movement and engagement in the form of higher allowances. It is foreseeable that this approach will not only continue into the RIIO-ED2 process but will be adopted by other regulators.

Either way, the movement from draft determinations and rhetoric in the ED2 SSMD may have signalled a change in Ofgem’s approach from their stance of policing and reducing bills, to working and engaging with the industry in a more collaborative and receptive manner to address the challenges the sector is facing in achieving net zero.

This will be welcomed by DNOs who have significant challenges relating to strategic investment to support UK’s ambitious ten-point plan and net zero – with the estimated doubling of electricity demand by 2050 set out in the Energy White Paper. With the significant and rapid pace of change ongoing in the sector and the increased focus from government, it is even more critical for networks to respond proactively to ‘get ahead of the game’.

At the same time, Ofgem should be looking at itself and maybe start to question whether the current form of the RIIO model form, with comparative regulation to benchmark costs, is really sufficient to support the mammoth task of enabling the governments’ net zero ambitions and investment, ahead of need. Either way, all of this is good news for RIIO-ED2. With Ofgem loosening its grip and being more receptive to the wider implications of the sector, this gives DNOs a significant opportunity to be the catalyst for change to a green recovery and a net zero future.

Please login or Register to leave a comment.