You’ve reached your limit!

To continue enjoying Utility Week Innovate, brought to you in association with Utility Week Live or gain unlimited Utility Week site access choose the option that applies to you below:

Register to access Utility Week Innovate

- Get the latest insight on frontline business challenges

- Receive specialist sector newsletters to keep you informed

- Access our Utility Week Innovate content for free

- Join us in bringing collaborative innovation to life at Utility Week Live

To ensure a successful energy transition, utilities must change the way they reward customers and start thinking in terms of services not commodities. Laura Sandys discusses these and other key findings from her ReCosting Energy report.

We have exciting challenging and essential tasks as a sector in relation to our customers – whether domestic or business.

We have exciting challenging and essential tasks as a sector in relation to our customers – whether domestic or business.

The big opportunity is the role that our customers can – and must – play in the energy sector through aggregated flexibility and energy efficiency. The route to delivering this flexibility is much deeper digitisation of customer assets and services. The biggest challenge however is how do we unlock access to the capital assets that customers need to decarbonise their heat and transport. None of these comes cheap and is no easy “sell”.

At the heart of the problem is that we are still selling a commodity. Firstly, who understands what a KWh is or does… but more fundamentally with increasing cost sitting in system management, it is not the commodity that will have the added value but what you do with it, where and at what time.

But to optimise, as well as to decarbonise, the hard to reach, we might need to deploy new equipment, and introduce new ways of consuming energy into peoples’ homes and businesses.

Services not commodities

Other than the rich, few will be able to find the capital to invest in these necessary assets – so how best to deploy them at scale?

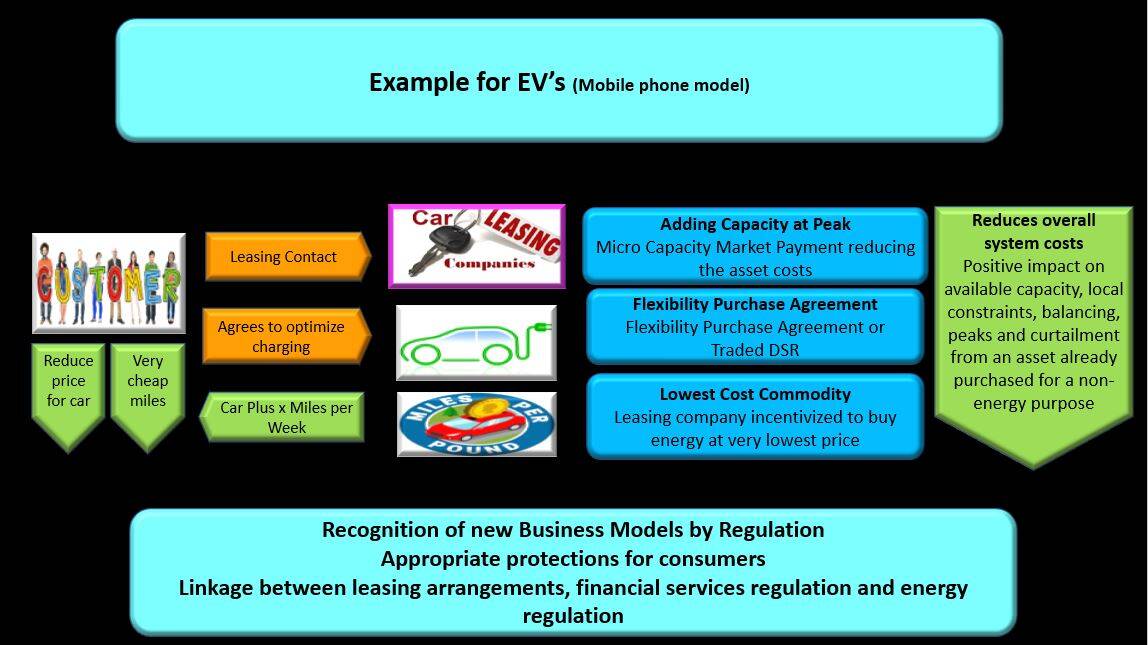

In the ReCosting Energy report we focused on how to create business models that can allow greater access to these assets. Our key recommendation is that we need to allow for many more busines models – moving from commodities to services enabling large companies to make the investment in the assets and then amortising their value over the service contract period.

There are some exciting models such as Social Energy and Sero and the Living Lab at the Energy System Catapult have direct consumer experience – and evidenced consumer delight – of the service model. However, this will not be enough to make assets really widely available.

Properly reward customers

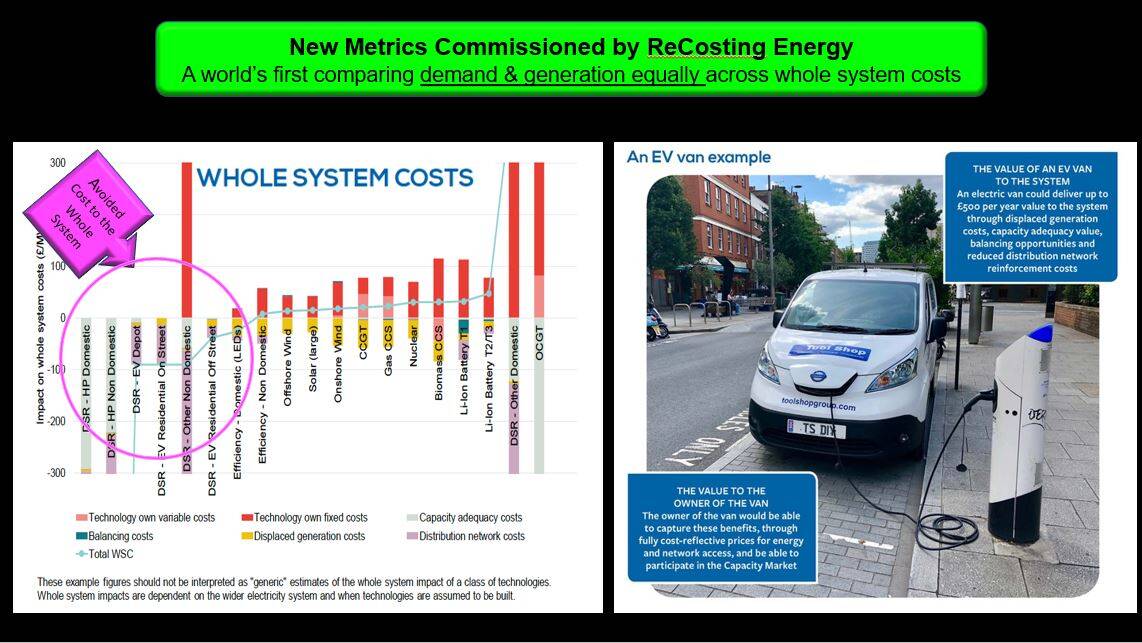

We need to reward customers for the fully loaded system value that they deliver the system. Currently it is only a simple flexibility payment for balancing and some emerging constraint management payments. However, if we are not to create butter mountains and milk lakes we need to reward them for all the other costs that they are helping the system avoid.

We did some exciting research with Frontier Economics, the BEIS modelling team and LCP that shows that against whole system costs and compared with generation, demand side assets have some really exciting value. And avoid costs for us all. But we need to ensure that this value flows through the system and doesn’t get caught in the current cost silos.

Treat demand equally to supply

We also need a mindset change within policy, regulation and the sector to regard demand actions as important as generation actions.

Let’s commend ourselves for being far ahead of other markets, but we have now arrived at a point where demand actions and their related assets are crucial to system costs, and system stability. The Bridging the Gap project by the ESO really highlights how technology, data and digitalisation and markets must come together to deliver sustainable business models.

But to recognise the equality, demand assets should be able to access similar support mechanisms to those that large developers can access. The investment period is similar for most customer-facing assets, and the financial “ask” is as big comparatively. So, these assets that deliver system value and increase capacity should be able to access with greater ease the capacity market and Contracts for Difference.

How this could work

We developed a model around a car leasing company that leased an EV to a customer with say 300 miles per week embedded into the contract – distancing the customer from the energy component. The leasing company would be able to access a micro capacity market payment, would sell flexibility options to the DNO and ESO and trade their customers battery according to the preference of the consumer, and at the same time the leasing company would be incentivised to charge the car at the very lowest price. This would reduce the cost of the car, offer the leasing company revenue streams that would further reduce their leasing contact costs to the customer.

Nothing new

There is nothing new in the world – and there is nothing that we propose in ReCosting Energy that is not adopted widely in other markets. The energy sector can learn the lessons from other sectors, adopt the best and avoid the worst, but we can move forward and deliver for customers and the planet by accelerating the deployment of demand assets, through services, and reward demand and supply equally.

Please login or Register to leave a comment.