You’ve reached your limit!

To continue enjoying Utility Week Innovate, brought to you in association with Utility Week Live or gain unlimited Utility Week site access choose the option that applies to you below:

Register to access Utility Week Innovate

- Get the latest insight on frontline business challenges

- Receive specialist sector newsletters to keep you informed

- Access our Utility Week Innovate content for free

- Join us in bringing collaborative innovation to life at Utility Week Live

The announcement of further heavy losses for 2019 continues to put the spotlight on British Gas owner Centrica. Adam John looks at the direction of travel now for the energy leviathan and who might be the person to lead it.

Even by the recent catalogue of corporate woes, Centrica’s announcement earlier this month that it had plunged into a loss of more than £1 billion must have been hard to take for outgoing chief executive Iain Conn. The parent company of Britain’s biggest energy supplier delivered its worst financial results since 2015, reporting a pre-tax loss of £1.1 billion for last year, massively down from a £575 million profit in 2018. Profits generated by British Gas fell by 71 per cent to £137 million, the lowest in the supplier’s history. It’s not the way any departing boss wants to be remembered.

But as he set out the results, Conn, who has been at the helm of the firm for the last five years, was nevertheless putting a brave face on proceedings. It had been a tough year, the introduction of the price cap and falling gas prices had dealt heavy blows – but his message was positive. “Against this backdrop Centrica delivered growth in customer accounts, higher net promoter scores, significant cost efficiencies in excess of our target, and full year adjusted operating cash flow and net debt within its target ranges,” he stressed.

“As expected, performance during the second half was much improved compared to the first half, demonstrating momentum as we enter 2020,” he added, pointing to increased customer satisfaction and efficiencies. He highlighted inroads in cost savings pledged at the interim results in July 2019 where he set out an aim for £1 billion of annual cost savings by 2022, on top of £1 billion already delivered. It also has the intention to become the cheapest supplier in the market. Conn said that in 2019, £315 million of cost efficiency savings were made, with a significant proportion of these coming from transforming its customer and field operations.

So, has Centrica reached its lowest ebb, or is there still some way to fall? And will the person who steps into Conn’s shoes when he finally departs feel that the direction of travel is the right one? Is the aim of becoming the cheapest energy supplier on the market by 2022 really achievable or advisable, given the losses that challenger brands are notching up? Or is it a business model that is doomed to extinction?

All these are questions the market is asking, with speculation growing as to who would want to take on such a daunting challenge. Especially as being a whipping boy for a sector still seen by many as ripping off consumers comes with the territory.

Sources say that one outside candidate has already turned down the role over concerns about the flak they would be likely to attract. Conn has certainly had his share. A pay rise of 44 per cent in 2018 to take his salary to £2.4 million, in what he described as a “challenging year”, was always going to attract opprobrium. And when it was announced in the summer of 2019 that he would be stepping down – but not until after the company AGM in 2020 – he and his chair were blasted in a Times leader. “It is hard to think of a more egregious record of failure in recent British corporate history than that of Iain Conn,” it thundered, perhaps somewhat harshly given the hand he was dealt when he joined from BP five years ago and strong head winds that have blown through the sectors since then. Also, let’s not forget his big move to focus on technology was praised at the time.

At last week’s results, Conn was keen to prove the criticism misguided, and that keeping him in post to see through a fight back strategy was paying dividends – if not literally. Conn sought to highlight the performance of the businesses it plans to keep, describing them as “relatively stable”. And he said that achieving “cost leadership” would enable sustainable customer and margin growth. A key focus, as in previous years, will be to bring the customer cost to serve down. It stood at £109 per British Gas customer in 2019, up 6 per cent from £103 the year previously which also includes a one-off bad debt credit of £8 per customer.

Though British Gas is still losing customers, its latest results show the rate of loss has slowed considerably. British Gas said goodbye to 286,000 customers in 2019 compared to the 742,000 it haemorrhaged the year before. The company reported its overall Consumer customer accounts were up 3 per cent to 722,000 on the back of bundling up products with energy and growth in cumulative home solutions customers, including growth from Centrica’s remote boiler diagnostics proposition, BoilerIQ, and cloud storage offer.

In short, the message was that the turnaround strategy was beginning to bear fruit.

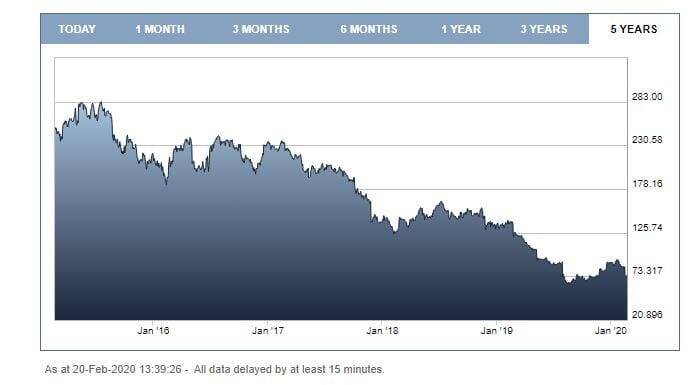

Yet the market remains to be convinced and the shares slumped to a 22-year low. In fact, since Conn took the reins, share prices have plummeted by almost 75 per cent – from 280p in early 2015 to 72p in February 2020. There has even been speculation that given its cut price shares, the company could be subject to a takeover by a large multinational firm, such as an oil giant for example, seeking to diversify and buy what is still perceived by many to be a good brand.

The markets were certainly taken back by Conn’s warning that the recent “significant” commodity price falls would negatively affect both Spirit Energy, its upstream oil and gas joint business, and its nuclear arm. Conn announced some time ago that it was trying to sell both of those businesses to focus on energy supply.

Meanwhile the venture into home services and the connected home, (a “£15 billion start-up” was how Conn described Centrica in 2017) – has not taken off in the way the company had hoped. Replacing the steady profits of supplying energy with cashflow from servicing boilers, selling Hive thermostats and supplying tradespeople via its Local Heroes website has resulted in heavy losses, and this has also been scaled back. It slashed the headcount in this part of the business by 40 per cent and with it, its expectations – though sales are rising steadily. It is now expected to deliver revenues of between £150 million and £200 million by 2022, down from a target of £1 billion.

Lakis Athanasiou, a utilities analyst at Agency Partners, believes the 40 per cent cut is a step towards ditching the home solutions business entirely. He tells Utility Week there is no silver bullet for Centrica’s strategy and that it should refocus and ditch its home solutions arm altogether.

“The strategy should now be focussed on delivery of efficiency and high service in residential and business energy supply, in order to become the lowest cost supplier, and efficiency and service in residential service, including driving North American residential services to profit rather than loss.

“Centrica should get rid of its home solutions business, it provides no competitive advantage and has been a strategic error, losing them close to £100 million a year. They are up against large companies with high technical expertise such as Amazon and Google. It is not an area where Centrica has especial expertise.”

Some question the strategy of beating rivals on price. One source says there needs to be more clarity from Centrica when it says it wishes to define itself as the cheapest supplier on the market by 2022. Specifically they question whether all its tariffs will be the cheapest, or only its standard variable tariff (SVT). “The statement doesn’t mean much in a world where there are very different prices for customers”, the source adds.

Others say Centrica should be playing harder to the green agenda and showing greater leadership in terms of its environmental aims. One industry source asserts that Centrica “needs to put its flag in the ground and say ‘this is what we are going to see’”.

“Over the next 20 years the UK will have to adapt, there will be a huge amount of fundamental change in services and products. Centrica has a fundamental role to play in that. It needs to lead the transformation – invest money, time and effort to lead this transformation to net zero and take themselves from the pariahs of the industry to part of the solution.”

The source adds that Centrica is in a position to lead the way in areas such as solar installations or EV charging. In last week’s financial results, the company did say it was preparing itself to “benefit from new market opportunities”, such as EV integration. Conn said Centrica’s new deal with Ford to provide electric vehicle tariffs and charge points was an example of “where we are moving to” in the future. To that end, it has upskilled around 100 of its engineers to install EV charging points in 2019. Though welcome to some, to others it is mere tinkering around at the edges.

One thing that is still going for it is its core brand, as one source points out: “Everybody has heard of British Gas. A household name is worth hundreds of millions on the balance sheet.”

Cometh the hour…. Cometh the man or woman

A new CEO was expected by some to be announced at the recent interim results. The fact it wasn’t perhaps suggests the difficulty of filling Iain Conn’s shoes. Sources say there are rumours that an external candidate has already turned the company down. Several are speculating the company is opting for an internal candidate this time, someone who is already familiar with Centrica and its board. An internal candidate would “make sense”, says one insider, who adds the company “does engender real loyalty”.

One name that has been mooted is Sarwjit Sambhi, chief executive of Centrica Consumer who is seen as fairly cautious and unlikely to rush into change, intuitively understanding what can and can’t be changed at this stage. A former senior employee said: “I worried slightly when Iain came in and the first decision – investing in the Hive platform – made real waves across the business. He overruled Ian Peters [former British Gas interim managing director] almost immediately. He saw the future business in tech and IOT.”

Furthermore, the source says, an internal candidate like Sambhi will have a “subtle understanding of what needs fixing”.

Sambhi has a long history with Centrica and joined the company almost 20 years ago. He stepped up to the board in March last year. Prior to joining Centrica, he worked for the management and technology consulting company Booz Allen and Hamilton. He is said by those in the know to be forward-thinking, customer focused and capable of making big decisions. Says one observer: “He understands the complexities of the business. He already sits on the board and it feels like he has got enough of a balance between skills and experience, and he has relationships across the most senior echelons of the business.”

Athanasiou agrees, sayin Sambhi would be a “welcome successor” and if appointed would show Centrica is not looking for a “quick fix such as gimmickry in terms of developing new businesses”.

A source close to the company describes Sambhi as “very smart, unassuming but confident, brave and bold and with the stamina to keep going”.

And yet there are those who believe Centrica should be hunting for a new chief executive from outside the organisation. One source tells Utility Week: “I think they need some new blood. Sarwjit has been there 20 years. He is part of the problem, not part of the solution.”

Another contender for the top job is Chris O’Shea, chief financial officer, who previously worked in technology-led engineering and services industries – he was group chief financial officer of both Smiths Group and Vesuvius, and a non-executive director of Foseco India, an Indian-listed supplier to the foundry industry.

Whoever takes the baton from Iain Conn will know they have a massive job on their hands and some very unforgiving critics watching their every step. The company has clearly outlined its intentions to become the cheapest supplier on the market by 2022 but in an era where many challenger brands have done just that before failing, there are some questioning whether this is the right road to follow.

Please login or Register to leave a comment.