This is the Sponsored paywall logged out

“All or most” consumers would be better off from full exposure to locational pricing when compared to the status quo of national wholesale power pricing, according to Ofgem.

The regulator highlighted this as one of the main conclusions from its assessment of locational pricing for the government’s ongoing Review of Electricity Market Arrangements (REMA).

Ofgem said locational pricing is likely to produce “significant benefits” for society when compared to the current arrangements. However, it also qualified that further work must be done to develop a “more realistic counterfactual” of improving locational price signals through other reforms such as changes to network charges, access arrangements and balancing markets.

The regulator mainly based its assessment on a new study of locational pricing, which it commissioned from FTI Consulting and was produced in partnership with the Energy Systems Catapult.

FTI explored three different market designs: a base case, representing the status quo of national pricing; a zonal market, in which Great Britain is split into seven distinct zones reflecting the expected bottlenecks on the transmission network; and a nodal market, in which prices are determined at around 850 nodes on the transmission network.

These market designs were modelled in three different scenarios: The Leading the Way (LtW) scenario from the Electricity System Operator’s (ESO) Future Energy Scenarios combined with the transmission network expansion set out in its Network Options Assessment 7 (NOA7); the LtW scenario combined with the transmission expansion set out in the ESO’s Holistic Network Design (HND); and the System Transformation (SysTr) scenario from the ESO’s Future Energy Scenarios combined with NOA7.

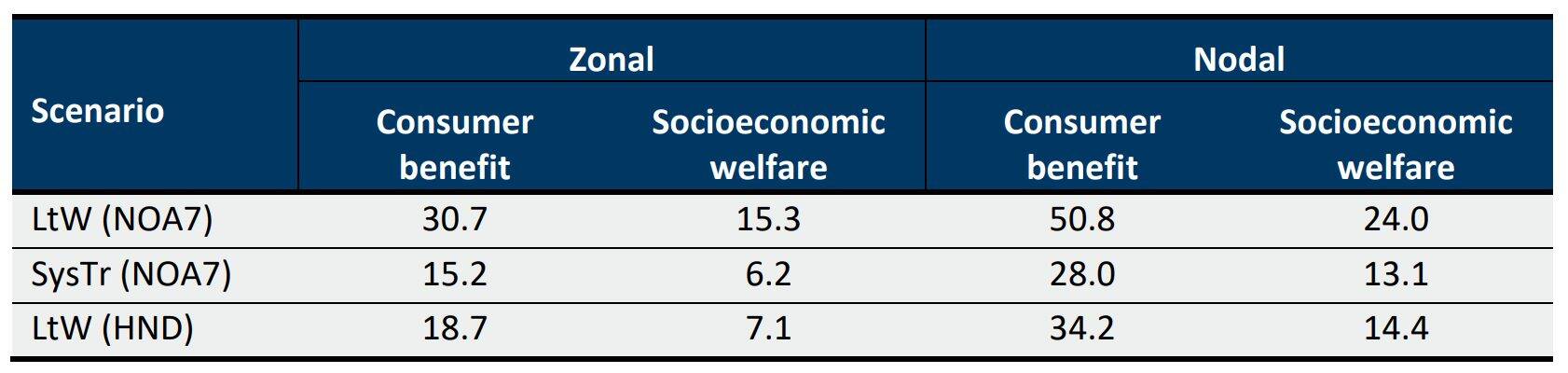

The consultancy found that the net benefits to society between 2025 and 2040 would range from £13 billion to £24 billion under nodal pricing, and £6 billion to £15 billion under zonal pricing. It said the net benefits to consumers would be more than double over the same period, ranging from £28 billion to £51 billion under nodal pricing, and £15 billion to £31 billion under zonal pricing. The greatest benefits in each range would be seen in the first scenario (LtW+NOA7).

Net present value of locational pricing between 2025 and 2040

The societal benefits do not include carbon dioxide emissions reductions, which would be lowered by 65 to 100 megatonnes under nodal pricing. FTI said these benefits would be worth an additional £12 billion to £18 billion.

According to FTI’s report, the lion’s share of benefits to consumers from locational pricing would come from the avoidance of network constraint costs. These costs have already risen from less than £200 million in 2010 to around £2 billion in 2022. Under current market arrangements, the report said these costs would rise significantly in all three scenarios, passing £5 billion per year by 2040 in the first scenario (LtW+NOA7).

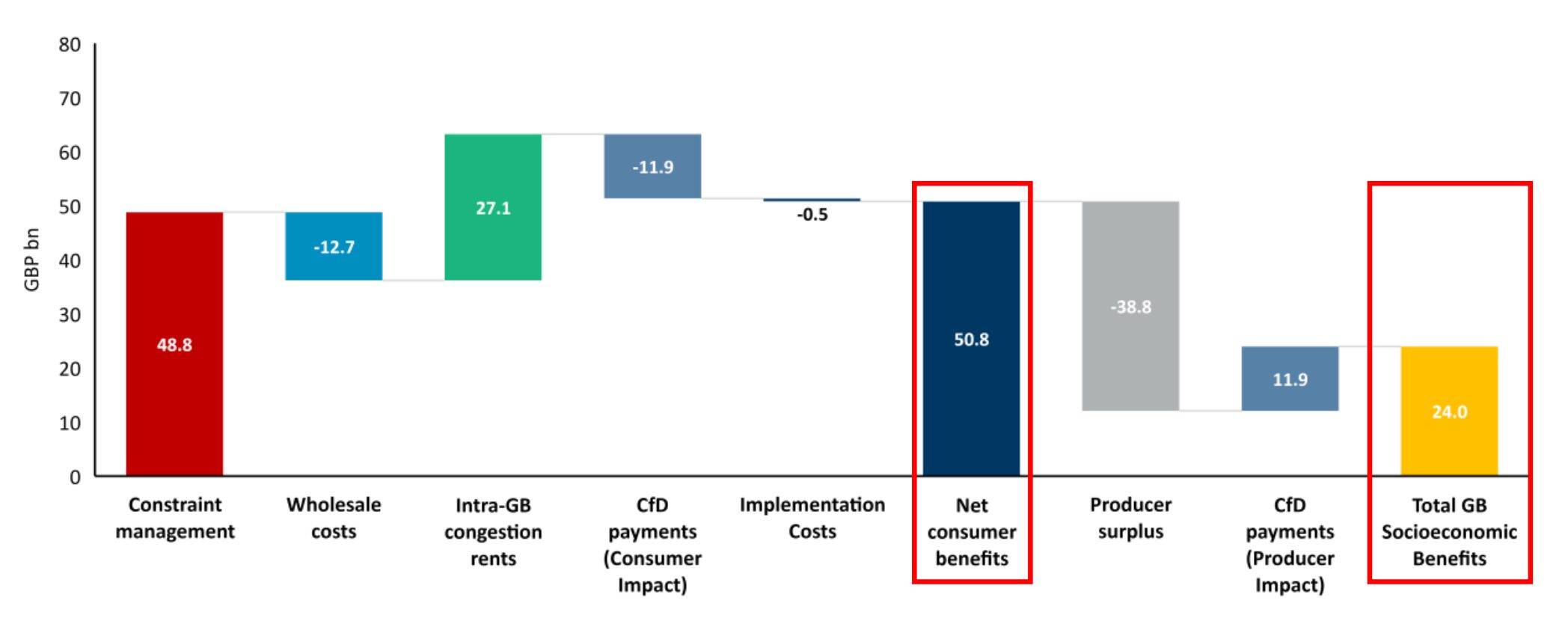

FTI said the avoidance of constraint costs would benefit consumers by almost £49 billion in this scenario. It said the other main benefit would be congestion rents – the surpluses that arise when electricity generated in an export constrained area is bought at a relatively low price but sold to consumers at a higher price after being transported across the transmission network.

The consultancy assumed that these benefits, worth more than £27 billion, would be passed back to consumers as is “commonplace in most locational markets of the world”. This could occur either directly, through the settlement process, or indirectly, through auctions for rights to the surpluses. In the case of the latter, these rights are often referred to as Financial Transmission Rights and enable market participants and traders to hedge against price risk between different locations.

Net present value of nodal pricing between 2025 and 2040 in first scenario (LtW+NOA7)

The report said these benefits would be partially offset by increased wholesale costs due to the incorporation of constraint costs, otherwise incurred by the ESO, into wholesale pricing. Although prices would fall in the north of Britain, where generation is plentiful, this impact would be more than offset by increased prices in the import-constrained south. The overall effect would a £13 billion increase in wholesale prices over the period.

Given that Contracts for Difference (CfD) top-up payments are calculated based on the difference between wholesale prices and strike prices, these payments would increase for generators in areas with lower wholesale prices. The report said this would further reduce the consumer benefits of nodal pricing in the first scenario by almost £12 billion.

The consumer benefits would lastly be reduced by the implementation costs for nodal pricing, which FTI estimated at around half a billion pounds. The consultancy said this “conservative” estimate is based on reviews of precedent from other countries as well as discussions with systems vendors and the ESO.

FTI said the societal benefits of nodal pricing would be significantly lower in the first scenario due to a £39 billion reduction in market revenues for generators, which would receive no constraint payments from the ESO and lower wholesale prices in some parts of the country. The latter would be partially offset by the aforementioned £12 billion increase in CfD payments.

The report said the benefits to consumers of locational pricing would vary significantly across the country, with those in the north benefitting more than those in the south. Consumers in Scotland would have the lowest average wholesale electricity prices across all of Western Europe.

However, FTI said “consumers in all regions” would see a net gain. Under nodal pricing in the first scenario, the net benefits to consumers between 2025 and 2040 would range from £3.4 billion in the GB7 region covering the southernmost parts of England to £12.6 billion in the GB4 region, which includes Yorkshire and North Wales.

The consultancy said its modelling also demonstrates the potential for locational pricing to reduce transmission investment. Under national pricing, FTI calculated the reduction in constraint costs resulting from the additional grid upgrades set out in the ESO’s HND (over above NOA7) at £26 billion (undiscounted) between 2025 and 2040. Under nodal pricing, this difference was estimated at just £3 billion.

FTI said the reduction in transmission investment would mainly come from improved siting decisions for assets and better use of two-way assets such as interconnectors.

It said national pricing can often mean flows from interconnectors exacerbate constraints, particularly in the case of imports from Norway and exports to France. Locational pricing would mean some of these flows would be reversed. More power would be exported to Norway when prices are low in Scotland and more power would be imported from France when prices are high in the south of England.

Critics have warned that a move to locational pricing would expose investors to increased merchant risk and therefore raise the cost of capital. However, FTI said it had found “limited evidence that this would, in practice, be a material cost”.

“Significant effects on cost of capital are only likely if investors are unable to manage their portfolio to take account of the increased volatility of one asset. Our review of experience in other jurisdictions identified little direct evidence on the impact of locational pricing on the cost of capital – indeed, it might be expected that investors would be better able to manage risks under locational pricing, for instance by investing in a portfolio of assets around Great Britain.”

The report claimed concerns over market liquidity are similarly unfounded: “We have analysed liquidity of wholesale markets in GB and in selected markets with locational pricing, and found that, if anything, there appears to be greater liquidity in markets with locational pricing relative to markets with national pricing.”

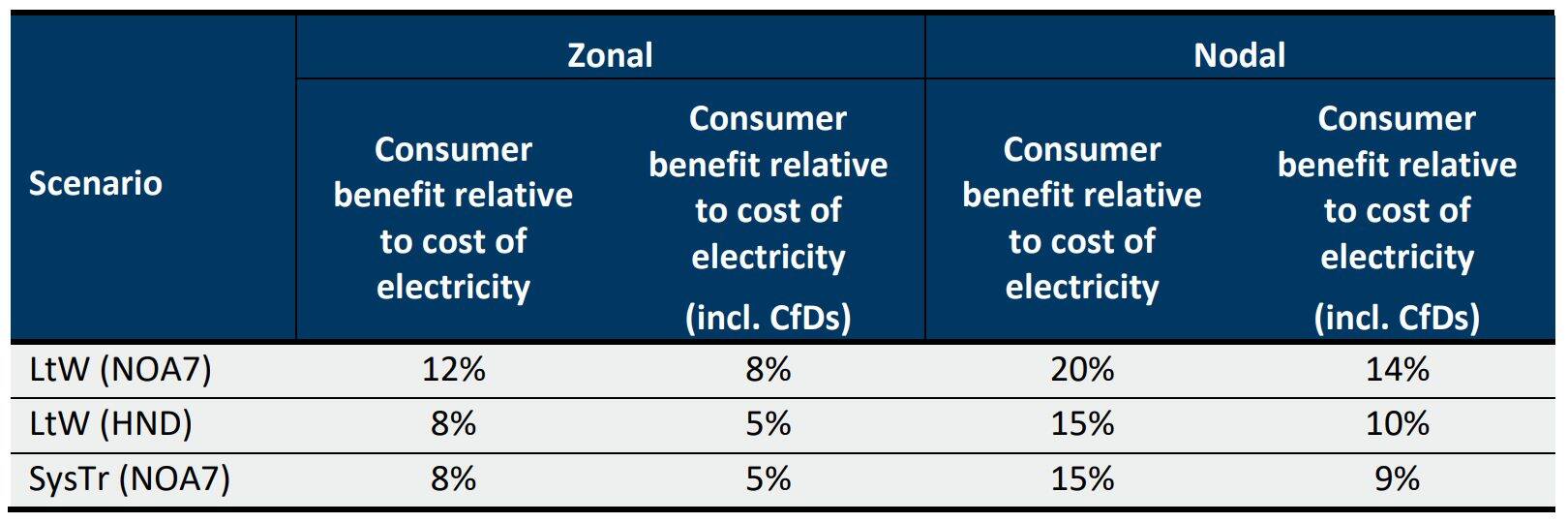

Delivering its assessment, Ofgem said the more than £34 billion of consumer benefits seen under zonal pricing in the second scenario (LtW+HND) would represent an average saving for domestic consumers of £38 per year – much greater than the expected £11 yearly benefit from its Mandatory Half-Hourly Settlement programme.

Consumer benefits of locational pricing relative to wholesale costs between 2025 and 2040

The regulator said the exact scale of the benefits would depend on several factors, noting that this scenario does not reflect the impact of any further transmission network upgrades beyond those approved under its Accelerated Strategic Transmission Infrastructure framework: “Simply put, the more the transmission network is upgraded to reduce network constraints, the lower the net benefits from locational pricing.”

Putting that aside, Ofgem said it has not identified “any realistic scenarios where locational pricing would not deliver significant benefits for both consumers and the GB economy, compared to current arrangements.”

Ofgem said other factors determining the exact benefits include the degree to which suppliers and their customers would be shielded from, or exposed to, locational prices.

However, the regulator said a “key finding” from its assessment is that “implementing locational pricing whilst shielding certain types of demand from locational prices could still deliver material system cost reductions and consumer benefits compared to current arrangements, albeit they would be lower.”

Furthermore, Ofgem said shielding consumers from locational prices would represent a “missed opportunity” as its distributional analysis of the FTI’s modelling found “all or most consumers would be better off”.

The regulator said locational pricing would be challenging to implement, requiring reforms to legislation, regulation and market rules: “As many jurisdictions have successfully transitioned to greater locational wholesale pricing, there is diverse experience for GB to draw upon.

“However, we have identified certain implementation challenges that could be difficult and/or expensive to address, notably compatibility with currently unknown future European Union-United Kingdom (EU-UK) trading arrangements, amending existing CfD contracts, any compensation arrangements for legacy contracts, and potential changes to metering.”

It continued: “Some of these changes will come at a cost and may disrupt existing business models and could impact the flow of investment in the sector. That is why we are also exploring alternatives that could, to a greater or lesser extent, deliver many of the benefits of locational pricing with potentially less disruption to existing market arrangements.”

Ben Shafran, head of markets, policy and regulation at the Energy Systems Catapult, said its work with FTI Consulting shows the “size of the prize” from locational pricing is “too big to ignore”.

“With an estimated saving of £51 billion when implementing locational pricing – for comparison, the government’s estimated savings from rolling out smart meters is £6 billion to 2034 – we have an opportunity to make a tangible difference to the lives of consumers, particularly amid a cost of energy crisis,” he explained.

Shafran said nodal pricing has the benefit of being “tried and tested internationally, in a widely diverse set of electricity markets, some of which are similar to our own.”

He said there also are reasons to believe their assessment may have “understated” the benefits of nodal pricing due to the assumption that it would not affect the siting decisions large consumers of electricity.

Furthermore, Shafran said even when they added the “very conservative” assumption that nodal pricing would have “no effect at all” on siting decisions for new renewable generators, the consumer benefits were still estimated at £39 billion between 2025 and 2040.

Rachel Fletcher, director of economics and regulation at Octopus Energy, which has been a prominent proponent of locational pricing, said: “Today’s electricity market arrangements stand in the way of getting to net zero efficiently and on time. A new approach is non-negotiable, with customers more than ever deserving a strategy that shields them from unnecessary costs.

“This detailed analysis from FTI and Energy Systems Catapult shows that we could save many billions a year by replacing the often meaningless average national wholesale price with markets that reflect the different system realities across the country – and the best thing is all households would benefit from it.”

Please login or Register to leave a comment.